20/4/10 Rule for Car Buying: The Smart Way to Financially Secure Car Purchases

Buying a car is a major financial decision that can significantly impact your monthly budget. While the allure of a shiny new car might be tempting, it’s essential to stay within your financial limits to avoid unnecessary debt. One of the best strategies for making a smart, budget-conscious car purchase is the 20/4/10 rule.

This rule provides a simple and practical framework for buying a car without jeopardizing your financial health. In this detailed guide, we’ll explore what the 20/4/10 rule is, why it’s essential, and how to implement it effectively.

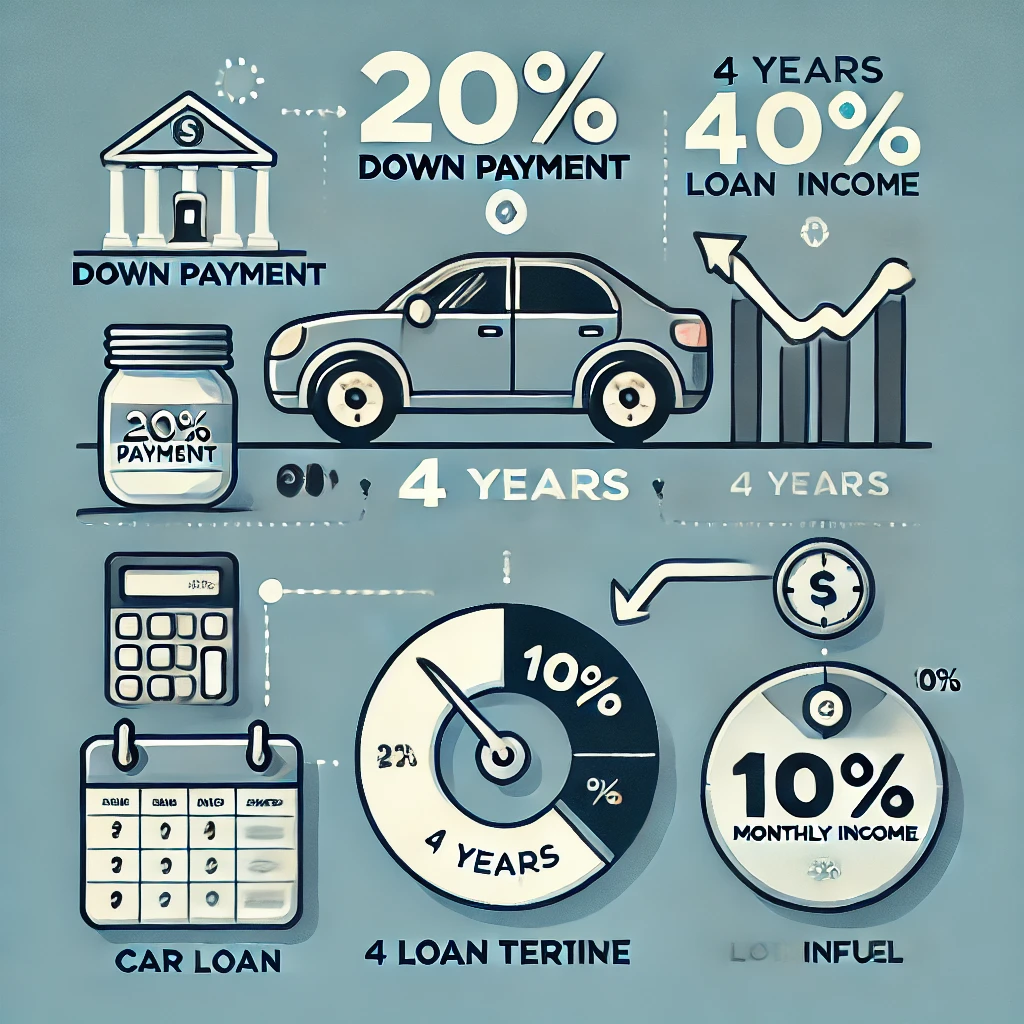

What is the 20/4/10 Rule?

The 20/4/10 rule is a guideline for car buying that emphasizes:

- 20% Down Payment: Pay at least 20% of the car’s purchase price upfront.

- 4-Year Loan Tenure: Opt for a loan term of no more than 4 years.

- 10% of Monthly Income: Limit your total car expenses (EMI, insurance, fuel) to 10% of your gross monthly income.

This rule helps prevent overborrowing, minimize interest payments, and maintain a balance between car expenses and other financial priorities.

Breaking Down the Rule

1. Pay 20% as a Down Payment

Making a substantial down payment reduces the amount you need to borrow. This has two significant benefits:

- Lower Loan Amount: Reducing the principal amount borrowed results in smaller monthly payments.

- Better Loan Terms: Larger down payments often lead to better interest rates and approval chances.

For example, if the car you want costs $30,000, a 20% down payment would be $6,000. Saving for this amount upfront may take time, but it ensures you start with a solid financial foundation.

2. Limit the Loan Tenure to 4 Years

Longer loan tenures might seem attractive because they lower monthly payments, but they also increase the total interest paid. A 4-year (48-month) loan strikes the right balance between affordability and cost.

Why a 4-year term?

- Minimized Interest Costs: The shorter the tenure, the less interest you pay overall.

- Faster Ownership: You own the car outright sooner, freeing up your finances for other priorities.

For instance, a $24,000 loan at 6% interest over 4 years costs less in interest compared to a 5- or 6-year term.

3. Keep Total Car Expenses Within 10% of Your Monthly Income

This part of the rule ensures that car-related costs don’t eat up too much of your budget. Total car expenses include:

- Monthly Loan EMI

- Car Insurance Premiums

- Fuel Costs

- Maintenance and Repairs

If your gross monthly income is $5,000, you should limit your total car expenses to $500 or less. This cap helps maintain financial stability and allows you to allocate funds to other needs like housing, savings, and leisure.

Why is the 20/4/10 Rule Important?

1. Prevents Overspending

It’s easy to be tempted by luxurious cars with advanced features, but overcommitting financially can lead to long-term stress. The 20/4/10 rule sets clear boundaries to keep you grounded.

2. Encourages Financial Discipline

Saving for a 20% down payment and choosing a shorter loan tenure instills disciplined financial habits.

3. Ensures Long-Term Financial Stability

Limiting car expenses to 10% of your income prevents overburdening your budget, allowing you to save and invest for the future.

How to Apply the 20/4/10 Rule

Step 1: Calculate Your Budget

Assess your gross monthly income and determine the maximum amount you can allocate for car expenses.

Step 2: Choose the Right Car

Research vehicles that fit within your budget. Factor in not just the car price but also additional costs like insurance, taxes, and fuel.

Step 3: Save for the Down Payment

If you haven’t saved enough for a 20% down payment, hold off on the purchase until you have the required funds. Use budgeting tools or automatic savings plans to build your down payment fund.

Step 4: Shop for the Best Loan

Compare loan offers from banks, credit unions, and online lenders. Look for competitive interest rates and avoid loans with long terms or hidden fees.

Step 5: Factor in Hidden Costs

Beyond the car price, account for costs like:

- Vehicle registration and taxes

- Regular maintenance and repairs

- Depreciation (especially for new cars)

Example of the 20/4/10 Rule in Action

Let’s say you’re considering a car priced at $35,000 and your gross monthly income is $6,000.

- Down Payment (20%):

$35,000 × 20% = $7,000 upfront - Loan Tenure (4 Years):

Loan amount = $35,000 – $7,000 = $28,000

At 6% interest for 4 years, monthly EMI = $656 - Monthly Expense Limit (10%):

10% of $6,000 = $600

Since $656 exceeds your $600 limit, this car might stretch your budget. Consider a less expensive car or a larger down payment to stay within the rule.

Adjustments to the 20/4/10 Rule

While the 20/4/10 rule is a great starting point, it may need adjustment based on:

- Location: Costs like insurance and fuel vary widely.

- Income Fluctuations: If you have an irregular income, allocate a buffer for car expenses.

- Car Type: A used car may allow you to deviate slightly from the rule while staying financially secure.

Final Thoughts

The 20/4/10 rule is more than just a formula; it’s a mindset for making financially sound decisions when buying a car. By sticking to these guidelines, you can enjoy the benefits of car ownership without compromising your financial stability.

Before making a purchase, remember: cars depreciate quickly, but your financial health should appreciate over time. Stick to the 20/4/10 rule, and you’ll be on the road to smarter spending and long-term wealth.

To stay updated to latest and trending news do follow us on: